Contents

Ale są też tak zwane fałszywe przebicia, które przecinają poziom wsparcia czy oporu nie na długo. Powszechnym sygnałem w tradingu jest przebicie linii oporu i wsparcia. Świadczy to o sile bieżącej tendencji i jej prawdopodobnej kontynuacji. Najważniejszym elementem analizy jest porównanie dynamiki ruchu krzywej On Balance Volume ze zmianą ceny. Uzupełniajcie wartości w odpowiednich różowych słupkach w wybranym okresie, poziom zamknięcia ceny i zakres w tym barze.

Czerwonym okręgiem zaznaczyłem taki fałszywy sygnał, gdzie krzywa równowagi wolumenu praktycznie ignoruje wzrost. Pragnę zaznaczyć, że przebicie linii trendowej w okienku równowagi wolumenu miało miejsce nieco wcześniej, niż na wykresie. Zysk został zanotowany od razu po zamknięciu przebitej świecy. Zaznaczyłem są świecę przy pomocy strzałki, a poziom wyjścia – zieloną linią.

- Na wykresie powyżej widać, że cena IBM poszła w dół po otwarciu krótkiej pozycji.

- Joseph Granville po raz pierwszy opracował metrykę OBV w książce z 1963 r.

- Witam Cię w kolejnym, dwudziestym czwartym odcinku naszej serii poświęconej kontraktom terminowym “Z dźwignią na GPW”, którą tworzymy we współpracy z Giełdą Papierów Wartościowych w Warszawie.

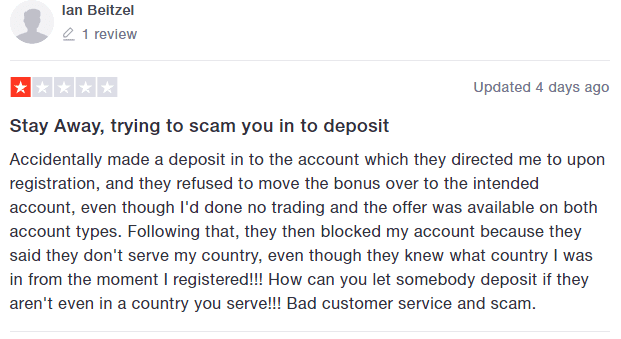

- Od 67% do 89% inwestorów traci swoje środki handlując CFD.

Wadą wszystkich wskaźników bazujących na wolumenie, jest ich zależność od danych, jakie wchodzą w skład indykatora. Z tego powodu OBV raczej ma niewielkie zastosowanie na rynkach, gdzie nie ma informacji o realnym wolumenie. Z takiego powodu On Balance Volume nie warto używać na rynku walutowym, albo na akcjach mało płynnych spółek. Ich głównym zadaniem jest zabezpieczanie przed przepięciami z powodu wyładowań atmosferycznych oraz innymi przepięciami pojawiającymi się podczas pracy urządzeń elektrycznych. Doskonałe parametry i wysoka jakość wykonania podstawowych podzespołów są gwarancją, iż ograniczniki przepięć DC czy AC należą do czołówki tego typu aparatów na rynku. Jeżeli ceny zmieniają się w tym samym kierunku a wskaźnik przełamuje swój trend to może oznaczać bliską zmianę tendencji w kursach.

BV – OBV (PS 45bar) Zawór kulowy dwukierunkowego działania

Zastanów się, czy możesz pozwolić sobie na wysokie ryzyko utraty twoich pieniędzy. Duża różnorodność sygnałów odwrócenia i kontynuacji trendu, kierunek krzywej, dywergencja z ceną, przebicie kluczowych poziomów i trendu. Na wykresie odzwierciedlono fioletowe linie, łączące szczyty świec i OBV. Tworzą one rozchodzenie, a zatem możemy dokonać prognozy odwrócenia trendu. Świadczy to o słabym udziale w ruchu cenowym poważnych graczy. Zatem nie ma żadnych przesłanek, świadczących o kontynuacji ruchu ceny, a to oznacza, że przebicie jest fałszywe.

Musisz rozważyć, czy jesteś w stanie ponieść ryzyko utraty zainwestowanych środków. Słysząc “trading dla początkujących”, mamy przed oczami płatne kursy, obiecujące w rekordowym czasie zmienić laika w rekina rynku. Traderzy wciąż poszukują technik, które pozwoliłyby im dokonywać skutecznej analizy rynku, a co za tym idzie, zmniejszać ryzyko strat i… Pamiętaj, że klikając przycisk „Nie zgadzam się” nie zmniejszasz liczby wyświetlanych reklam, oznacza to tylko, że ich zawartość nie będzie dostosowana do Twoich zainteresowań.

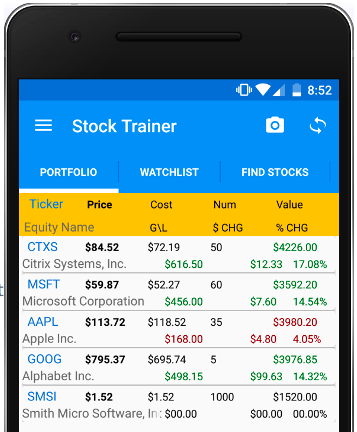

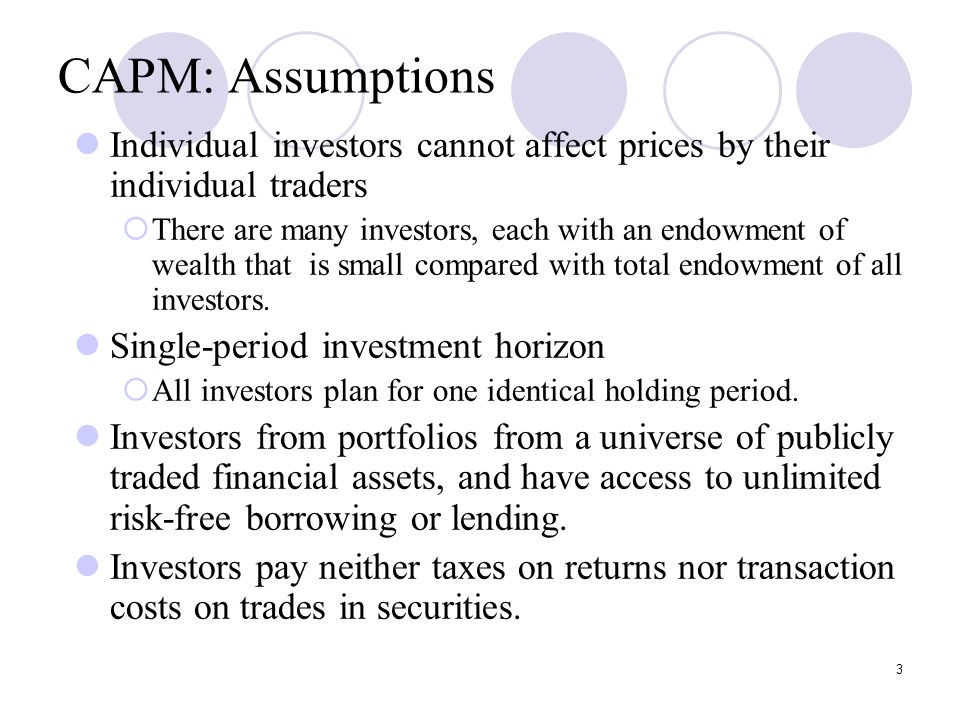

Oznacza to, że mimo wzrostu cen, wyższy wolumen pojawia się podczas spadków. Wskaźnik wolumenu OBV jest indykatorem analizującym momentum rynkowe. Jego konstrukcja opiera się na założeniu, że analiza zmian wolumenu pozwala na przewidzenie przyszłego zachowania się cen. Wskaźnik On Balance Volume został stworzony przez Josepha Granville, który opisał wspomniany indykator w książce “The Granville Market”, która została wydana w 1963 roku. Joseph Granville uważał, że to wolumen jest kluczową siłą, która porusza rynkiem. Był zdania, że skok wolumenu bez znacznej zmiany ceny może być sygnałem, że szykuje się znaczna zmiana cen w przyszłości .

Gdzie oferowana jest niższa cena?

OBV używany jest często w roli wskaźnika pomocniczego, uzupełniającego sygnały innych wskaźników. Jego zmodyfikowaną i ulepszoną wersją jest wskaźnik A/D (Accumulation/Distribution). Plik 1855 cent obv.jpg znajduje się w Wikimedia Commons – repozytorium wolnych zasobów. Geometria rynku nie jest metodą, a raczej zbiorem metod, które jednoczą się w poglądzie, zgodnie z którym przyszłe ceny instrumentu… Z jednej strony maklerzy i inwestorzy indywidualni, a z drugiej giełda i nadzór.

Wkrótce nałoży się na to osłabienie popytu konsumpcyjnego. Prześlij nam swój adres e-mail, a my powiadomimy Cię o nowych produktach, najlepszych cenach, promocjach i wyprzedażach. Dokładność sygnałów na starszych interwałach na wysokim poziomie. W efekcie zysk notuje się wg ustalonego poziomu TP, zielona linia.

Wszystkie modele wyposażyliśmy w sygnalizację zadziałania za pomocą widocznego wskaźnika stanu na przodzie aparatu, lub też poprzez opcjonalne styki pomocnicze – sygnalizacja dźwiękowa lub świetlna. Przykładowo, gdy kurs rośnie, podczas gdy Jak opublikować swoje wyniki handlu spada może to świadczyć o końcu hossy i spadku kursu w najbliższej przyszłości. Natomiast, gdy podczas bessy OBV zaczyna rosnąć może to świadczyć o końcu bessy i nadchodzącym wzroście kursu. Na screenie widoczna jest faza akumulacji przed wzrostem zaprezentowana za pomocą wskaźnika OBV.

Zastanów się, czy rozumiesz, jak działają kontrakty CFD, i czy możesz pozwolić sobie na wysokie ryzyko utraty twoich pieniędzy. Inwestycje na rynku forex z wykorzystaniem dźwigni finansowej obarczone są dużym ryzykiem poniesienia straty, łącznie z możliwością utraty wszystkich zainwestowanych funduszy. Prosimy o upewnienie się czy rozumieją Państwo ryzyka związane z transakcjami na rynku forex lub zasięgnięcie porady niezależnego doradcy co do zaangażowania w tego typu transakcje. Forex.pl promuje usługi finansowe licencjonowanych podmiotów zarejestrowanych w Unii Europejskiej. Nie prowadzimy bezpośredniej sprzedaży produktów finansowych. Przedstawiamy ofertę wyłącznie dla nieokreślonego adresata.

BV – OBV (PS 45bar) Zawór kulowy dwukierunkowego działania

Wskaźnik wygląda jak najprostszy wykres z jedną linią sygnałową. Szczegółową instrukcję o dodawaniu wskaźników na wykres MetaTrader 4 opisywałem w artykule “Czym jest wskaźnik Wstęg Bollingera na Forexie”. Liteforex LTD, firma regulowana https://investdoors.info/ przez CySEC z numerem licencji 093/08, nie świadczy usług brokerskich w twoim kraju. Oświadczam, że zapoznałem się i akceptuję regulamin prawny Rankia. Upoważniam Rankia do zbierania i przetwarzania moich danych osobowych.

MonitorFX tworzymy z pasji do tradingu online na globalnym rynku finansowym.Transakcje CFD i Forex oparte na dźwigni finansowej są wysoce ryzykowne dla Twojego kapitału. Dlatego CFD i Forex mogą nie być odpowiednie dla wszystkich inwestorów giełdowych. Upewnij się, że rozumiesz związane z tym ryzyko i w razie potrzeby zasięgnij niezależnej porady. Witam Cię w kolejnym, dwudziestym czwartym odcinku naszej serii poświęconej kontraktom terminowym “Z dźwignią na GPW”, którą tworzymy we współpracy z Giełdą Papierów Wartościowych w Warszawie.

W takim przypadku pozwala on zarówno obliczyć wskaźnik najbardziej pasuje do instrumentów handlowych. W takim przypadku pozwala on zarówno na obliczanie punktu odwrócenia, https://forexformula.net/ jak i wykrywania skłonności rynku do kontynuacji bieżącej tendencji. Co się tyczy interwałów, to narzędzie to lepiej nie wykorzystywać na wykresach krótkoterminowych.

Wskaźnik wolumenu OBV – budowa

Na wykresie schematycznie została odzwierciedlona dywergencja niedźwiedzia . Podczas ruchu ceny do góry obserwuje się płynny spadek wskaźników. Podczas analizy tego wskaźnika, inwestor powinien skupić się głównie na jego trendzie. Bieżąca wartość OBV jest nieistotna w tym sensie, że zawiera wiele danych z przeszłości i nie ma względnego porównania między OBV jednego instrumentu a OBV innego. Z drugiej strony, jeśli badamy ostatni trend OBV, możemy określić, czy presja kupna lub sprzedaży wzrasta lub maleje.

Wszystkie zainteresowane strony będą, już za zamkniętymi drzwiami, rozmawiać też o modelu finansowania tego „biznesowego projektu” z partnerem z Azji. Od samego początku nowe regulacje budziły wątpliwości z uwagi na niejasny zakres ich zastosowania. Ustawodawca wprowadził szereg nowych pojęć, które do tej pory nie były znane (np. promotor, korzystający, wspomagający, kryterium głównej korzyści podatkowej). Doświadczenia ostatnich 3 lat pokazały, że wielu podatników nie wie, w jakich sytuacjach mogą pojawić się u nich obowiązki z zakresu MDR. W październiku zwolnił wzrost produkcji przemysłowej oraz jej cen.

Jeśli trend został już ustalony, obowiązuje on do momentu zmiany. Zmiana trendu wielkości bilansowej może nastąpić na dwa sposoby. W pierwszym przypadku, trend zmienia się z byczego na niedźwiedzi, lub z niedźwiedziego na byczy.

Gwałtowny skok wskaźnika świadczy o udziale poważnych graczy, w płynny wzrost – o przyłączeniu się do handlu pozostałego tłumu. Jeśli trend wskaźnika Wolumenu Równowagi zmienia się z byczego na niedźwiedzi, następuje tzw. Ponieważ załamania wskaźników zwykle poprzedzają załamania cen, w przypadku wzrostowych załamań OBV inwestorzy powinni zajmować pozycje długie. Z kolei, w przypadku spadkowych, odpowiednio sprzedawać. Pozycje powinny być otwarte do momentu zmiany kierunku trendu. Jeśli cena w swoim ruchu przekracza wskaźnik Wolumenu Równowagi, jest to nazywane „brakiem potwierdzenia”.

Na bardzo niskich interwałach rośnie rola rzeczywistej zmienności lub szumu cenowego. W takim przypadku On Balance Volume może dawać nieprawidłowe wskazania. Małe opóźnienie wskaźnika, a większości przypadków możliwość wyprzedzającego sygnału. W celu otwarcia transakcji na zakup EMA 12 powinna przecinać EMA 34 z dołu w górę, a na sprzedaż – z góry do dołu.

On Balance Volume można wykorzystać razem z innymi narzędziami analizy technicznej do filtracji i potwierdzenia sygnałów. W ten sposób traderzy zawodowi znacznie podwyższają prawdopodobieństwo pozytywnego rezultatu transakcji. O jednym z nich, Wstęgach Bollingera, pisałem szczegółowo w poprzednim artykule, mianowicie tu. Po rozpatrzeniu wskaźnika OBV, opisu jego sygnałów w stosunku do właściwości, przejdziemy do cech handlu na rynku Forex.